Blog

PIB

Daily PIB

Daily PIB/ 08 Feb

General Studies- II

Topic- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

BY Chrome Ias

Share

Trending

Latest Courses

Corporatisation of Ordnance Factories

Context:

According to the reply given in the Parliament by Government:

The Government is committed to safeguard the interests of erstwhile Ordnance Factory Board (OFB), as mentioned at various forums including during interactions with the Federations.

Accordingly, the Government has taken the following steps:

- Till such time, the employees remain on deemed deputation to the new DPSUs, they shall continue to be subject to all the extant rules, regulations and orders as are applicable to the Central Government servants, including related to their pay scales, allowances and other service conditions.

- The pension liabilities of the retirees and existing employees will continue to be borne by the Government.

Background:

In June 2021, The Union Cabinet approved a plan to corporatize the Ordnance Factory Board (OFB).

- Later, the ‘Essential Defence Services Bill, 2021’ was passed by the Lok Sabha.

- The Bill aims to prevent the staff of the government-owned ordnance factories from going on a strike.

Ordnance Factory Board (OFB):

It is an umbrella body for the ordnance factories and related institutions, and is currently a subordinate office of the Ministry of Defence (MoD).

- The first Indian ordnance factory was set up in the year 1712 by the Dutch Company as a GunPowder Factory, West Bengal.

- OFBs are responsible for different verticals of the products such as the Ammunition and Explosives group will be engaged in production of ammunition while a Vehicles group will engage in production of defence mobility and combat vehicles.

Proposed changes:

- According to the plan, the 41 companies will reportedly be grouped under the new entities.

- These new entities will function like any other existing defence public sector undertaking (DPSU) like Hindustan Aeronautics Ltd (HAL) or Bharat Electronics Limited (BEL).

Who will it affect?

It has a direct bearing on around 70,000 employees of the 41 ordnance factories around the country, who are unhappy with the corporatisation of OFB, fearing that it will impact their service and retirement conditions.

Reason behind this Restructuring?

As per Comptroller and Auditor General (CAG) report on the ordnance factories:

- Production in factories continued to fall short of targets and, that the various ordnance factories could achieve targets for only 49 per cent of items in 2017-18.

- A significant quantity of Army’s demand for some principal ammunition items remained outstanding as of 31 March 2018 which may adversely affect their operational preparedness.

Thus, inefficiencies in production and delays can be deemed to be a primary reason behind the overhaul of OFB.

The New Structure:

- The restructuring is aimed at transforming the ordnance factories into productive and profitable assets, deepen their specialisation in product range, enhance competitiveness and improve quality and cost-efficiency.

- The restructure would help in overcoming various shortcomings in the existing system of the OFB by eliminating inefficient supply chains and provide these companies incentive to become competitive and explore new opportunities in the market.

- It will allow these companies autonomy as well as help improve accountability and efficiency.

Concerns with corporatization:

- Corporatisation would eventually lead to privatisation.

- The new corporate entities would not be able to survive the unique market environment of defence products that has very unstable demand and supply dynamics.

Restructuring will result in greater autonomy and lesser government control over the corporation but there is a fear of job loss.

General Studies- II

Topic- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Startup India Seed Fund Scheme

Context:

Startup India Seed Fund Scheme (SISFS) was approved for the period of next four years starting from 2021-22.

- It will be implemented with effect from 1st April 2021.

- Rs. 945 Crore corpus will be divided over the next 4 years for providing seed funding to eligible startups through eligible incubators across India.

- The scheme is expected to support about 3600 startups.

Objective:

The Scheme aims to provide financial assistance to startups for proof of concept, prototype development, product trials, market entry and commercialization.

Benefits under ‘Atmanirbhar Bharat’ for Startups:

By Reserve Bank of India: Rescheduling of Payments – Term Loans and Working Capital Facilities:

- In respect of all term loans were permitted to grant a moratorium of three months on payment of all instalments falling due between March 1, 2020 and May 31, 2020.

- In respect of working capital facilities sanctioned in the form of cash credit/overdraft , lending institutions were permitted to defer the recovery of interest applied in respect of all such facilities during the period from March 1, 2020 upto May 31, 2020.

- Kamath Committee: According to the recommendations of an expert committee, RBI has specified five specific financial ratios and the sector-specific thresholds for each ratio in respect of 26 sectors to be taken into account while finalising the resolution plans.

Easing of Working Capital Financing:

In respect of working capital facilities sanctioned to borrowers facing stress on account of the economic fallout of the pandemic, lending institutions may recalculate the ‘drawing power’ by reducing the margins and/or by reassessing the working capital cycle.

Measures for businesses including MSMEs – These measures would support eligible startups;

- Rs 3 lakh crore Emergency Working Capital Facility for Businesses,including MSMEs.

- Rs 20,000 crore Subordinate Debt for Stressed MSMEs.

- Rs 50,000 crore Equity infusion for MSMEs through Fund of Funds.

New definition of MSME:

- The definition of micro manufacturing and services unit increased to Rs. 1 crore of investment and Rs. 5 crores of turnover.

- The limit of small unit increased to Rs. 10 crore of investment and Rs 50 crore of turnover.

- The limit of a medium unit increased to Rs 20 crore of investment and Rs. 100 crores of turnover.

- The limit for medium manufacturing and service units was further increased to Rs. 50 crore of investment and Rs. 250 crores of turnover.

It has also been decided that the turnover with respect to exports will not be counted in the limits of turnover for any category of MSME units whether micro, small or medium.

Production-Linked Incentive (PLI) Scheme:

- For enhancing India’s Manufacturing Capabilities and Enhancing Exports – Atmanirbhar Bharat, the PLI Scheme in the 10 key sectors were introduced.

- This will make Indian manufacturers globally competitive, attract investment in the areas of core competency and cutting-edge technology; enhance exports and make India an integral part of the global supply chain.

- It aims to overall growth in the economy and create huge employment opportunities.

Reliefs through Employee Provident Fund (EPF):

- Under Pradhan Mantri Garib Kalyan Package (PMGKP), payment of 12% of employer and 12% employee contributions was made into EPF accounts of eligible establishments.

EPF contribution reduced for Business & Workers for 3 months:

- Under this package the statutory rate of EPF contribution of both employer and employee has been reduced to 10 percent of basic wages and dearness allowances from existing rate of 12 percent for all class of establishments covered under the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952.

Need for:

The Indian startup ecosystem suffers from capital inadequacy in the seed and proof-of-concept development stage.

- Many startups die because of the lack of risk-taking appetite in the Indian investment ecosystem.

- This is the reason why unlike the US or China, India hasn’t seen enough of product innovations and instead remained to be a service provider.

General Studies- II

Topic- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Integrated Skill Development Scheme

Context:

Government is implementing various policy initiatives and schemes for supporting the development of textile sector.

About the ISDS:

- The Integrated Skill Development Scheme (ISDS) is introduced to cater to skilled manpower needs of Textile and related segments such as apparel, handicrafts, handlooms, jute, sericulture & technical textiles through skill development training programs.

- The Scheme will enhance the capacity and employability of the targeted trainees as it covers all facets of skill development such as basic training, skill upgradation, advanced training in emerging technologies, training of trainers, orientation towards modern technology, managerial skill etc.

Background:

The textiles sector has the second largest employment after agriculture sector and occupies an important position in the Indian economy.

- It also contributes 14% to industrial production, 4% to India’s GDP and constitutes to 13% of country’s export earning, with over 45 million people employed directly.

- As per the NSDC report, the overall employment in the textile and clothing sector expected to increase from about 33 to 35 million in 2008 to about 60 to 62 million by 2022.

- This would translate to an incremental humanresource requirement of about 25 million persons by 2022.

- Of this, the mainstream textile and clothing sector has the potential to employ about 17 million persons incrementally till 2022.

Scheme Reach

- The scheme has a wide spread reach with training being conducted in almost all Indian States/ UTs etc. Around 3,250 training centers are present across different Indian States, cities and rural areas including remote location, backwards region, left wing extremist affected area etc.

- Out of the total 664 districts Indian districts, around 357 districts have been covered under the scheme and trainees from different strata of the society are the major beneficiaries.

Chrome facts for Prelims

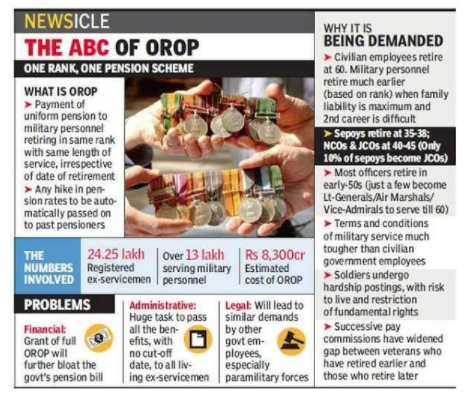

One Rank One Pension Scheme

The Government took a historic decision of implementing One Rank One Pension (OROP) for Defence Forces Personnel with effect from 01 July 2014.

- OROP implies that uniform pension be paid to Defence Forces Personnel retiring in the same rank with the same length of service, regardless of their date of retirement.

It implies bridging the gap between the rates of pension of current and past pensioners at periodic intervals.

National Safety Council

National Safety Council (NSC) was set up by the Ministry of Labour, Government of India (GOI) on 4th March, 1966.

- It was established to generate, develop and sustain a voluntary movement on Safety, Health and Environment (SHE) at the national level.

- It is an apex nonprofit making, tripartite body, registered under the Societies Registration Act 1860 and the Bombay Public Trust Act 1950.

Activities:

- Organizing and conducting specialised training courses, conferences, seminars & workshops;

- Conducting consultancy studies such as safety audits, hazard evaluation & risk assessment;

- Designing and developing HSE promotional materials & publications;

- Facilitating organisations in celebrating various campaigns e.g. Safety Day, Fire Service Week, World Environment Day.

A computerized Management Information Service has been setup for collection, retrieval and dissemination of information on HSE aspects.

BY Chrome Ias

Trending

Latest Courses

For Daily Updates

Sign up for daily emails to get the latest Chrome IAS news.