Blog

Editorials

Daily Editorials

Editorials In-Depth, 23 Feb

Account Aggregator Network

General Studies- III (Indian Economy and issues relating to planning)

BY Chrome Ias

Share

Trending

Latest Courses

Account Aggregator (AA) network, a financial data-sharing system was unveiled in India recently.

- It could revolutionize investing and credit, giving millions of consumers greater access and control over their financial records and expanding the potential pool of customers for lenders and fintech companies.

- The Account Aggregator system in banking has been started off with eight of the India’s largest banks.

- The Account Aggregator system can make lending and wealth management a lot faster and cheaper.

What is an Account Aggregator?

According to the Reserve Bank of India, an Account Aggregator (AA) is a non-banking financial company engaged in the business of providing, under a contract, the service of retrieving or collecting financial information pertaining to its customer.

It is also engaged in consolidating, organising and presenting such information to the customer or any other financial information user as may be specified by the bank.

- Data cannot be shared without the consent of the individual.

- There will be many Account Aggregators an individual can choose between.

- Account Aggregator replaces the long terms and conditions form of ‘blank cheque’ acceptance with a granular, step by step permission and control for each use of your data.

How does it work?

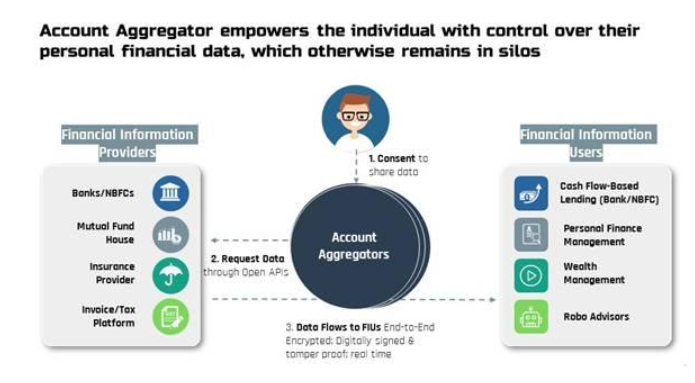

It has a three-tier structure:

- Account Aggregator,

- FIP (Financial Information Provider) and

- FIU (Financial Information User).

Financial Information Provider (FIP) is the data fiduciary, which holds customers’ data. It can be a bank, NBFC, mutual fund, insurance repository or pension fund repository.

- An FIU consumes the data from a Financial Information Provider (FIP) to provide various services to the consumer.

- An FIU is a lending bank that wants access to the borrower’s data to determine if the borrower qualifies for a loan.

- Banks play a dual role – as an FIP and as an FIU.

Through Account Aggregator, a company can access tamper-proof secure data quickly and cheaply, and fast track the loan evaluation process so that a customer can get a loan.

Can an AA see or store data?

- Data transmitted through the Account Aggregator (AA) is encrypted.

- AAs are not allowed to store, process and sell the customer’s data.

- No financial information accessed by the AA from an FIP should reside with the AA.

- It should not use the services of a third-party service provider for undertaking the business of account aggregation.

- User authentication credentials of customers relating to accounts with various FIPs shall not be accessed by the AA, the RBI says.

- An AA should share information only with the customer to whom it relates or any other financial information user as authorised by the customer.

AA Network system:

- The AA framework was created through an inter-regulatory decision by RBI and other regulators including Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority (IRDA), and Pension Fund Regulatory and Development Authority (PFRDA) through and initiative of the Financial Stability and Development Council (FSDC).

- The licence for AAs is issued by the RBI, and the financial sector will have many AAs.

Benefits of AA Network system:

- It reduces the need for individuals to wait in long bank queues, use Internet banking portals, share their passwords, or seek out physical notarisation to access and share their financial documents.

- An Account Aggregator is a financial utility for secure flow of data controlled by the individual.

- Account Aggregators are an exciting addition to India’s digital infrastructure as it will allow banks to access consented data flows and verified data.

- This will help banks reduce transaction costs, which will enable us to offer lower ticket size loans and more tailored products and services to our customers.

- It will also help reduce frauds and comply with upcoming privacy laws.

Source: The Hindu

BY Chrome Ias

Trending

Latest Courses

For Daily Updates

Sign up for daily emails to get the latest Chrome IAS news.