Source: The Hindu, Live Mint and Indian Express

NATIONAL GREEN HIGHWAYS MISSION

Context: The National Highways Authority of India (NHAI) on Tuesday informed the National Green Tribunal that around 1 crore trees have been planted across the country along highways in the past three years to maintain ecology and environmental balance.

Essentials

National Green Highways Mission

- Under the Green Highways Project, the government has made it mandatory to set aside 1 per cent of the total project cost of any NH contract to a Green Fund corpus that will be used for plantation purposes.

- The afforestation is expected to help in sequestering approximately 12 lakh mt carbon annually.

- Adopt a Green Highway’ Program: The National Green Highway Mission initiated the program’ to engage corporates, Public Sector units, Government organizations and other institutions for developing green corridor along National Highways through plantation and allied activity on avenue, median and other available nearby land patches.

- Kisan Harit Rajmarg Yojana: The Yojana is a pilot scheme to extend green belt beyond the existing ‘Right of Way’ of highways by engaging farmers and providing alternative livelihood option to the nearby communities.

CHILIKA LAKE

Context: The Centre and Odisha government have decided to restore the ecology of the Chilika Lake ravaged by Cyclone Fani recently.

Essentials

Chilika Lake

- Chilika is a shallow lagoon with estuarine character in Odisha.

- Lagoons are areas of relatively shallow, quiet water situated in a coastal environment and having access to the sea but separated from the open marine conditions by a barrier.

- An estuaryis a partially enclosed coastal body of brackish water with one or more rivers or streams flowing into it, and with a free connection to the open sea. Estuaries form a transition zone between river environments and maritime environments.

- The Daya and Bhargavi rivers feed the lake.

- Seawater is Chilika’s lifeblood. Without a regular inflow, the lake ecosystem would decline.

- It is the largest wintering ground for migratory waterfowl found anywhere on the Indian sub-continent.

- Pulicat Lake is the second largest brackish water lake or lagoonin India, after Chilika Lake.

- The endangered Irrawaddy dolphins are also found in the lake, which is the single largest habitat of this species in the world.

- On account of its rich bio-diversity and ecological significance, Chilika was designated as the 1st “Ramsar Site” of India.

- The Nalaban Island within the lagoon is notified as a Bird Sanctuary under Wildlife (Protection) Act.

- The lake was included in the Montreux Record (threatened list) in 1993 due to change in its ecological character by Ramsar Convention but was later removed from it due to the successful restoration of the site.

Montreux Record under the Ramsar Convention

- It is a register of wetland sites on the List of Wetlands of International Importance where changes in ecological character have occurred, are occurring, or are likely to occur as a result of technological developments, pollution or other human interference.

- It is maintained as part of the Ramsar List.

- The Montreux Record was established by Recommendations of the Conference of the Contracting Parties (1990).

- Sites may be added to and removed from the Record only with the approval of the Contracting Parties in which they lie.

- Currently, two wetlands of India are in Montreux record viz. Keoladeo National Park, Rajasthan and Loktak Lake, Manipur.

WEST NILE VIRUS

Context: The presence of the West Nile virus was identified from the mosquito samples collected from a few districts of kerala.

Essentials

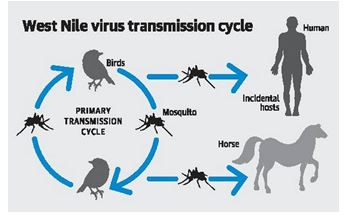

- West Nile virus is mainly transmitted to people through the bites of infected mosquitoes of the Culex genus.

- Birds are the natural hosts of West Nile virus. Mosquitoes become infected when they feed on infected birds, which circulate the virus in their blood for a few days.

- West Nile virus can cause a fatal neurological disease in humans.

- However, approximately 80% of people who are infected will not show any symptoms.

- The virus can cause severe disease and death in horses.

- Vaccines are available for use in horses but not yet available for people.

- WNV is commonly found in Africa, Europe, the Middle East, North America and West Asia.

- West Nile Virus (WNV) belongs to the Japanese encephalitis antigenic complex of the family Flaviviridae.

- The virus may also be transmitted through contact with other infected animals, their blood, or other tissues.

- To date, no human-to-human transmission of WNV through casual contact has been documented, and no transmission of WNV to health care workers has been reported when standard infection control precautions have been put in place.

NATIONAL TECHNICAL RESEARCH ORGANISATION (NTRO)

Context: The Coast Guard received inputs from the National Technical Research Organisation (NTRO) about a Pakistani ship trying to enter Indian waters.

Essentials

- The National Technical Research Organisation (NTRO) is a technical intelligence gathering agency under the National Security Advisor in the Prime Minister’s Office, India.

- It was set up in 2004.

- It also includes National Institute of Cryptology Research and Development (NICRD), which is first of its kind in Asia.

- NTRO has the same “norms of conduct” and similar powers as the Intelligence Bureau (IB) and the Research and Analysis Wing (R&AW).

- The Union Home Ministry in May 2018 issued a notification listing NTRO under the Intelligence Organisations (Restriction of Rights) Act, 1985 — a demand of the organisation for over a decade.

- The act prevents employees of a notified agency from forming unions/associations, bars them from communicating with the press or publishing a book or other document without permission of the head of the intelligence organisation.

- It acts as a super-feeder agency for providing technical intelligence to other agencies on internal and external security.

- The agency is under the control of India’s external intelligence agency, Research and Analysis Wing, although it remains autonomous to some degree.

- The organisation does hi-tech surveillance jobs, including satellite monitoring, terrestrial monitoring, internet monitoring, considered vital for the national security apparatus.

- The NTRO will operate India’s sole spy ship, following its completion of sea trials at Vishakhapatnam.

COMPETITION COMMISSION OF INDIA (CCI)

- Context: The Competition Commission of India (CCI) is looking into allegations that Maruti forces its dealers to limit the discounts they offer, effectively stifling competition among them, and harming consumers who could have benefited from lower prices if dealers operated freely.

Essentials

Competition Commission of India

- The Competition Act, 2002, as amended by the Competition (Amendment) Act, 2007:

- prohibits anti-competitive agreements;

- abuse of dominant position by enterprises and;

- regulates combinations (acquisition, acquiring of control and M&A),

- which causes or likely to cause an appreciable adverse effect on competition within India.

- The objectives of the Act are sought to be achieved through the Competition Commission of India (CCI), a quasi-judicial body.

- CCI consists of a Chairperson and 6 Members appointed by the Central Government.

Objective of Competition Commission of India (CCI)

- Remove negative competitive practices

- Promote sustainable market competition

- Protect the rights of the consumer

- Protect the freedom of trade in Indian markets

- Protect the rights of small traders from the large traders to ensure their survival

- Advice and give suggestions to Competition Appellate Tribunal

- Run informative campaigns and create public awareness about fair competitive practices.

- The Commission is also required to give opinion on competition issues on a reference received from a statutory authority established under any law and to undertake competition advocacy, create public awareness and impart training on competition issues.

- The Competition Appellate Tribunalwas formed in 2009 and is a fully empowered body by the Constitution of India. The final appeal after this tribunal can be made in the Supreme Court of India.

COMMODITY DERIVATIVES MARKETS

Context: The Securities and Exchange Board of India (SEBI) has given the go-ahead to mutual funds (MFs) to participate in the commodity derivatives segment.

Essentials

- In June 2017, SEBI opened up the commodity derivatives markets to institutional investors for the first time by allowing hedge funds registered as category III Alternative Investment Funds (AIFs) to invest in commodity derivatives as ‘clients’.

- The category III AIFs raise money from high net worth individuals and corporates with a minimum contribution of Rs.10 million by each investor.

- AIFs have been allowed to invest in all commodity derivatives products on the conditions that they should not invest more than 10 per cent of the investable funds in one underlying commodity and they should periodically report their market exposure in commodity derivatives.

- These conditions have been specifically imposed on hedge funds because such players employ leverage on a substantial basis and use complex trading strategies to make short-term returns, thereby posing a systemic risk to the entire market.

- On September 26, 2017, SEBI allowed Foreign Portfolio Investors (FPIs) to participate in commodity derivatives contracts traded in stock exchanges operating in International Financial Services Centre (IFSC).

- Established as a part of a Special Economic Zone (SEZ), Gujarat International Finance Tec-City is the first IFSC in India that provides financial services to non-residents and residents in any currency other than the Indian Rupee.

- FPIs have been permitted to trade in commodity derivatives contracts subject to three conditions:

- they can only trade in non-agricultural commodities derivatives contracts (such as gold and silver);

- contracts would be cash settled on the settlement price; and

- all the transactions shall be denominated in foreign currency only.

The Entry of Banks into Broking Services

- In September 2017, the Reserve Bank of India (RBI) allowed banks to provide broking services to the commodity derivatives market through a separate subsidiary set up for the purpose or an existing subsidiary.

- The RBI has prescribed minimum capital requirements and other conditions on banks to become clearing members of commodity derivatives segments.

- Further, a bank’s subsidiary cannot undertake trading in commodity derivatives using its own capital (‘proprietary positions’) so as to make a profit for itself.

- However, it can earn fees and commissions from processing trades done by trading members/clients.

- This is for the first time that banks have been allowed to participate in the Indian commodity derivatives markets.

- It is important to emphasize here that all scheduled commercial banks (except regional rural banks) have been allowed to offer broking services for commodity derivatives trading.

- In other words, a wide range of banks in India, such as State Bank of India (state-owned), ICICI Bank (private sector), Deutsche Bank (foreign bank) and Apna Sahakari Bank (cooperative bank), can now offer broking services for commodity derivatives trading through subsidiaries.

- In the past one year, SEBI has undertaken other initiatives to introduce new products and removed restrictions on broking services.

- For instance, commodity exchanges have been allowed to introduce options trading.

- Besides, SEBI has allowed integrated broking activities in equity and commodity derivatives markets under a single entity.

- Now, a stock broker can deal in commodity derivatives trading without setting up a separate entity.

The Future Plans

- SEBI plans to allow portfolio management services (PMS) providers to participate in commodity derivatives market.

- The PMS is used by high net-worth investors and is offered by various entities including banks, brokerages, independent investment managers and asset management companies.

- Besides, the SEBI may also permit foreign institutional investors (FIIs) to invest directly in the commodity derivatives markets with new regulatory norms for such entities.

Basics

What is a Commodity?

- Commodity is a physical good attributable to a natural resource that is tradable and supplied without substantial differentiation by the general public: energy, grains, industrial (base) metals, livestock, precious metals, and softs (cash crops).

- Commodities trade in physical (spot) markets and in futures and forward markets.

- Spot markets involve the physical transfer of goods between buyers and sellers; prices in these markets reflect current (or very near term) supply and demand conditions.

- Global commodity futures markets constitute financial exchanges of standardized futures contracts in which a price is established in the market today for the sale of some defined quantity and quality of a commodity at a future date of delivery; execution of the contract may be focused on cash settlement or physical delivery.

What are Institutional Investors?

- An institutional investor is a person or organization that trades securities in large enough quantities that it qualifies for preferential treatment and lower fees.

- A retail investor is a non-professional investor who buys and sells securities through brokerage firms or savings accounts.

- Most institutional investors invest other people’s money on their behalf. They are the pension funds, mutual funds, money managers, insurance companies, investment banks, commercial trusts, endowment funds, hedge funds, and also some private equity investors.

What Is a Derivative?

- A derivative is a financial security with a value that is reliant upon or derived from, an underlying asset or group of assets.

- The derivative itself is a contract between two or more parties, and the derivative derives its price from fluctuations in the underlying asset.

- The most common underlying assets for derivatives are stocks, bonds, commodities, currencies, interest rates, and market indexes.

- These assets are commonly purchased through brokerages.

What is options trading?

- Options are contracts that give the bearer the right, but not the obligation, to either buy or sell an amount of some underlying asset at a pre-determined price at or before the contract expires.

- Options are instruments that belong to the derivatives family, which means its price is derived from something else.

How are Options different from Stocks?

- The Options contract has an expiration date unlike stocks. Stocks on the other hand do not have an expiration date.

- Unlike Stocks, Options derive their value from something else and that’s why they fall under the derivatives category.

- Options are not definite by numbers like Stocks

- You can profit from a drop in the price of an underlying stock. In fact, you can profit in all directions depending upon the type of position or strategy you are holding unlike stocks where you make a loss when the stock price goes downwards.

- Options owners have no right (voting or dividend) in a company unlike Stock owners.

In brief

- The UN World Economic Situation and Prospects Report has lowered its forecast for India’s GDP growth in 2019-20 to 7.1% from its estimate in January of 7.5%, citing an overall slowdown in global growth.