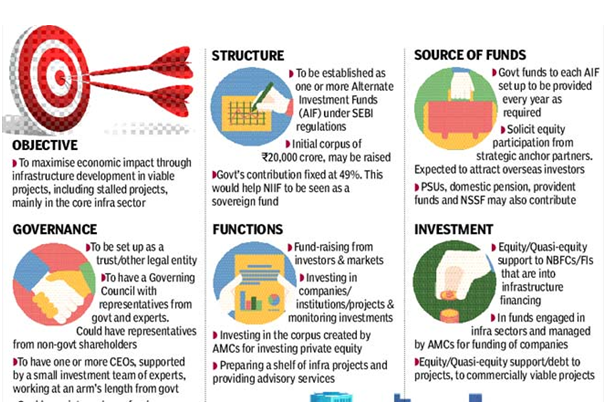

NIIF to get up to $2 bn

Economy

- AustralianSuper and Ontario Teachers’ will now join the Government of India (GOI), Abu Dhabi Investment Authority (ADIA), Temasek, HDFC Group, ICICI Bank, Kotak Mahindra Life Insurance and Axis Bank as investors in the NIIF fund.

- With this, NIIF Master Fund becomes the largest infrastructure fund in India with assets under management of over $1.8 billion and a co-investment pool of $2.5 billion, which will enable the fund to invest at the scale required for large infrastructure requirements in India.

- The Master Fund has a tenure of 15 years and is denominated in Indian rupees to suit the requirements of the infrastructure sector.

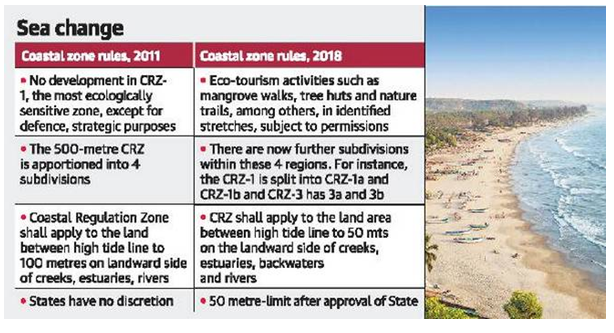

Centre unveils plan for coastal zone management

Environment

- The Environment Ministry has unveiled a draft plan that will dictate how prospective infrastructure projects situated along the coast ought to be assessed before they can apply for clearance.

- The draft Environmental and Social Management Framework (ESMF) is part of a World Bank-funded project.

- So far three coastal States, namely Gujarat, Odisha and West Bengal, have prepared Integrated Coastal Zone Management Plans with support from the World Bank. Such plans would be prepared for the selected coastal stretches in other States/UTs.

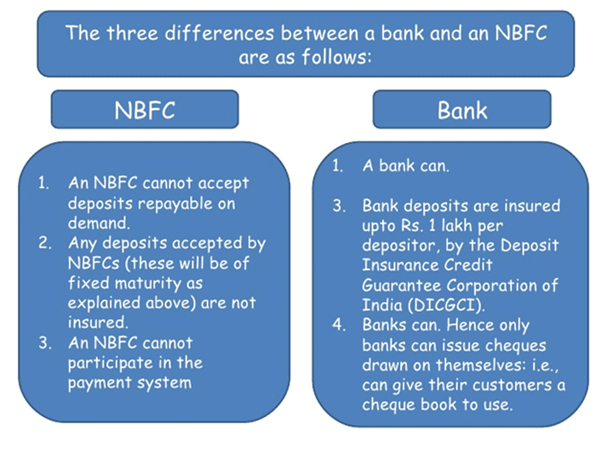

Banks get more headroom for lending to NBFCs

Economy

- The on-going liquidity crunch faced by non-banking finance companies (NBFCs) has made the Reserve Bank of India (RBI) to take further measures to increase credit flow to the sector.

- The central bank has decided to increase the cap on a bank’s exposure to a single NBFC to 20% of its tier-I capital from 15% now.

- Further, RBI has decided to give ‘priority sector’ tag for banks lending to NBFCs, for on-lending to farm, small and medium enterprises and housing sector.

- Banks have been allowed to lend to the NBFCs for on-lending to the agriculture sector up to ₹10 lakh, up to ₹20 lakh to micro and small enterprises, and for housing, up to ₹20 lakh per borrower. These will be classified as priority sector lending.