Source: The Hindu, Live Mint and Indian Express

SCO/BIMSTEC

Context: India has invited several heads of state, including those from the Bay of Bengal community (BIMSTEC) and the Shanghai Cooperation Organisation (SCO), for Prime Minister Narendra Modi’s swearing-in ceremony.

Essentials

Shanghai Cooperation Organisation

- The Shanghai Cooperation Organisation (SCO) is a permanent intergovernmental

- The SCO grew out of the Shanghai Five grouping — of Russia, China, Kazakhstan, Tajikistan and Kyrgyzstan — which was set up in 1996 to resolve boundary disputes between China and each of the four other members.

- It admitted Uzbekistan in 2001, re-christened itself the Shanghai Cooperation Organisation and broadened its agenda to include political, economic and security cooperation.

- In June 2017 in Astana (the capital city of Kazakhstan), India and Pakistan became full members of the Organization.

- The admission of India and Pakistan has expanded the geographical, demographic and economic profile of the SCO, which now has about half the world’s population and a quarter of its GDP.

- The SCO has four observer States: Afghanistan, Belarus, Iran and Mongolia.

- The SCO has six dialogue partners: Azerbaijan, Armenia, Cambodia, Nepal, Turkey, and Sri Lanka.

- The Heads of State Council (HSC) is the supreme decision-making body in the SCO which meets once a year.

- The organisation has two permanent bodies— the SCO Secretariat based in Beijing and the Executive Committee of the Regional Anti-Terrorist Structure (RATS) based in Tashkent.

- The SCO Secretary-General and the Director of the Executive Committee of the SCO RATS are appointed by the Council of Heads of State for a term of three years.

- The SCO’s official languages are Russian and Chinese.

- Shanghai Cooperation Organization sometimes also referred as ‘Eastern NATO’.

- The SCO’s main goals are as follows:

- strengthening mutual trust and neighbourliness among the member states;

- promoting their effective cooperation in politics, trade, the economy, research, technology and culture, as well as in education, energy, transport, tourism, environmental protection, and other areas;

- making joint efforts to maintain and ensure peace, security and stability in the region; and

- moving towards the establishment of a democratic, fair and rational new international political and economic order.

- Regional Anti-Terrorist Structure (RATS) of the SCO – It coordinates cooperation for security and stability, through intelligence-sharing on criminal and terrorist activities.

- Kyrgyzstan is the current chair of the SCO, which will host the organisation’s summit in Bishkek next month.

Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC)

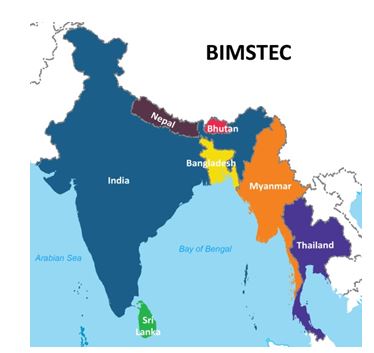

- The Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) is a regional organization comprising seven Member States lying in the littoral and adjacent areas of the Bay of Bengal constituting a contiguous regional unity.

- This sub-regional organization came into being in June 1997 through the Bangkok Declaration. It is headquartered in Dhaka, Bangladesh.

- It constitutes seven Member States: five deriving from South Asia, including Bangladesh, Bhutan, India, Nepal, Sri Lanka, and two from Southeast Asia, including Myanmar and Thailand.

- Initially, the economic bloc was formed with four Member States with the acronym ‘BIST-EC’ (Bangladesh, India, Sri Lanka and Thailand Economic Cooperation).

- The regional group constitutes a bridge between South and South East Asia and represents a reinforcement of relations among these countries.

- BIMSTEC has also established a platform for intra-regional cooperation between SAARC and ASEAN members.

- Unlike many other regional groupings, BIMSTEC is a sector-driven cooperative organization.

- Starting with six sectors—including trade, technology, energy, transport, tourism and fisheries—for sectoral cooperation in the late 1997, it expanded to embrace nine more sectors—including agriculture, public health, poverty alleviation, counter-terrorism, environment, culture, people to people contact and climate change.

Objectives of BIMSTEC

- To accelerate the economic growth and social progress in the sub-region through joint endeavours in a spirit of equality and partnership.

- To promote active collaboration and mutual assistance on matters of common interest in the economic, social, technical and scientific fields.

- To provide assistance to each other in the form of training and research facilities in the educational, professional and technical spheres.

- To maintain close and beneficial cooperation with existing international and regional organizations with similar aims and purposes.

BIMSTEC’s Principles

- Cooperation within BIMSTEC will be based on respect for the principle of sovereign equality, territorial integrity, political independence, no-interference in internal affairs, peaceful co- existence and mutual benefit.

- Cooperation within BIMSTEC will constitute an addition to and not be a substitute for bilateral, regional or multilateral cooperation involving the Member States.

Upcoming summit

- Nepal hosted the fourth BIMSTEC Summit in August 2018.

- The 5th BIMSTEC Summit will be hosted by Sri Lanka.

18-point Kathmandu Declaration: Key Points (only)

- Nepal handed over the chairmanship of the grouping to Sri Lanka.

- The Kathmandu Declaration was unanimously adopted by the member states.

- Deplore terrorist attacks in all parts of the world including in BIMSTEC countries.

- Establishing a BIMSTEC Development Fund (BDF).

- Acknowledge the importance of enhancing the visibility and stature of BIMSTEC in international fora.

- The declaration underlined the importance of multidimensional connectivity, which promotes synergy among connectivity frameworks in the region, as a key enabler to economic integration for shared prosperity.

PAYMENTS BANKS

Context: Plea filed in Delhi High Court against PayTM Payments Bank Limited for violating norms.

Essentials

Registration and regulation of business

- Payment Banks (“PB”) are to be registered as public limited companies under the Companies Act, 2013.

- They are to be licensed under Sec 22 of the Banking Regulation Act, 1949.

- PBs are to be given the status of scheduled banks under the section 42 (6) (a) of the Reserve Bank of India Act, 1934.

- However, the words “Payments Bank” have to be used by the companies in their name in order to differentiate it from other banks.

- Payments and Settlement Systems Act, 2007 will be a binding legislation for Payments Banks.

- They will be governed by the provisions of the:

- Banking Regulation Act, 1949;

- Reserve Bank of India Act, 1934;

- Foreign Exchange Management Act, 1999;

- Payment and Settlement Systems Act, 2007;

- Deposit Insurance and Credit Guarantee Corporation Act, 1961; and other relevant Statutes and directives.

- The guidelines will be reviewed by the RBI

- RBI’s main aim to push for payments bank is to serve the need of different banking activities in the rural areas.

Objectives

- To enhance financial inclusion by providing

- small savings accounts and

- payments/remittance services to: migrant labour workforce, low income households, small businesses, unorganised sector entities and other users.

The scope of Activities

- Acceptance of demand deposits: A maximum balance of Rs. 1L per customer is allowed (from both individuals and small businesses).

- Issuance of ATM/debit cards. Cannot issue credit cards.

- Payments and remittance services through various channels.

- PBs can act as Business Correspondents (“BCs”) of another bank.

- Distribution of non-risk sharing simple financial products like mutual fund units and insurance products, etc.

- Internet Banking: RBI is open to PBs offering Internet Banking services.

- PBs can undertake utility bill payments on behalf of its customers and the general public.

Deployment of Funds

- PBs cannot undertake lending activities.

- They need to maintain as Cash Reserve Ratio (CRR) with the RBI on its outside demand and time liabilities.

- PBs are also required to invest minimum 75 per cent of its “demand deposit balances” in Statutory Liquidity Ratio (SLR) eligible Government securities/treasury bills with maturity up to one year and hold maximum 25 per cent in current and time/fixed deposits with other scheduled commercial banks for operational purposes and liquidity management.

- Capital Adequacy Ratio: 15 %

- KYC application: Electronic authentication and most of the KYC norms to banks are applicable to PBs.

- Participation in Call Money Market* and CBLO** Market: Permitted to participate in CMM and CBLO as lenders and borrowers.

- *The call money market (CMM) is the market where overnight (one day) loans can be availed by banks to meet liquidity.

- **A collateralized borrowing and lending obligation (CBLO) is a money market instrument that represents an obligation between a borrower and a lender as to the terms and conditions of a loan.

Capital requirement

- The minimum paid-up equity capital for payments banks shall be 100 crore.

- The payments bank will have a leverage ratio of not less than 3% which basically mean that its outside liabilities should not exceed 33.33 times its net worth (paid-up capital and reserves).

- A leverage ratio is any one of several financial measurements that look at how much capital comes in the form of debt (loans) or assesses the ability of a company to meet its financial obligations.

Promoter’s contribution

- The promoter’s minimum initial contribution to the paid-up equity capital of the payment bank has to be at least 40% for the first five years after the commencement of business.

Foreign shareholding

- It will be according to the FDI Policy for private sector banks which is notified from time to time.

- The permitted limit right now is 74% out of which 49% can be through the automatic route and the remaining 25% beyond 49% will be through the government route.

Other Conditions

- Operations have to be technology and network driven from Day I.

- PBs should have a Customer Grievances Cell which is able to handle the customer complaints.

The advantage of Payment Banks over Traditional Banks

- Interest Rates: Payment banks are offering a really good deal in the case of interest rate in comparison to a commercial bank

- Zero balance account: Payment banks offer a zero balance account or a no minimum balance account without any extra or hidden charge, unlike a commercial bank who levy charges if the customer doesn’t hold a minimum balance in their account.

List of Payment Banks in India

- Aditya Birla Nuvo

- Airtel M Commerce Services

- Cholamandalam Distribution Services

- Department of Posts

- FINO PayTech

- National Securities Depository

- Reliance Industries

- Sun Pharmaceuticals

- Paytm

- Tech Mahindra

- Vodafone M-Pesa

- India Post

- *Cholamandalam Distribution Services, Sun Pharmaceuticals and Tech Mahindra have surrendered their licenses.

Small Banks v. Payment Banks

| Small Finance Banks (“SB”) | Payment Banks |

| SBs can accept deposits and can offer loan products. | PBs can open small saving accounts and accept deposits of upto Rs. 1 lakh per individual. |

| SBs can provide debit card facilities. | PBs can issue debit cards but they are not allowed to provide credit card facilities. |

| SBs are allowed to set up their own ATMs. | PBs are allowed to set up their own ATMs. |

| SBs can lend money. | PBs cannot lend any money to the general public. |

| SBs can accept all types of deposits – fixed deposits, term deposits, recurring deposits etc. | PBs cannot accept fixed deposits, term deposits, recurring deposits etc. |

| The main objective of SBs is to provide banking services to small farmers, micro and small industries, and the unorganized sector. | The main objective of a PB is to provide banking services to the migrant labour workforce, low-income households, small businesses and other unorganised sectors. |

AKASH MISSILE

Context: The DRDO on Monday successfully test-fired the new version of the Akash surface-to-air defence missile system with a new indigenously-developed seeker in Balasore off the Odisha coast. This is the second successful test of the missile following another on Saturday.

Essentials

- The medium range multi-target engagement capable missile was developed as part of the Integrated Guided-Missile Development Programme (IGMDP) other than Nag, Agni, Trishul, and Prithvi missiles.

- The supersonic missile has a range of around 25 km and up to the altitude of 18,000 metres.

- The missile uses high-energy solid propellant for the booster and ramjet-rocket propulsion for the sustainer phase. The missile system is said to be highly mobile.

- Several variants of the missile — Akash MK1, Akash-MK2 — with improved accuracy and higher ranges are under development by the DRDO.

- The missile system was formally inducted into the IAF and the Army in May 2015.

- However, it had been bogged in controversies with a Comptroller and Auditor General (CAG) report in 2017 stating that 30% of the missiles failed when tested.

- India is slowly plugging the holes in its air defence elements by developing the advanced surface-to-air missile named MRSAM — Medium Range Surface to Air Missile in collaboration with Israel.

- Besides that, five regiments of the renowned S-400 air defence system are under procurement from Russia. The delivery is slated to begin in 2020.

RAKSHAK

- The Mahindra Rakshak is an armored military light utility vehicle made by Mahindra Defense Systems, based on the chassis of the Mahindra Commander jeep.

- The Rakshak was designed to be used in counter-insurgency and anti-terrorism operations.

- The bullet-proof Rakshaks are specially designed vehicles by Mahindra Defence Systems for crowd control.

- The vehicle has armoured plating by Plasan Sasa, a variety of steel fabricated in Israel.