Source: The Hindu, Live Mint and Indian Express

HOW ARE MEMBERS OF THE EUROPEAN PARLIAMENT ELECTED?

Context: Elections to the European Parliament are underway.

Essentials

- European elections are held every five years. It is the only institution in the EU directly elected by citizens.

- Each member state has a fixed number of members of the European Parliament (MEPs); from six for Malta, Luxembourg, Cyprus and Estonia to 96 for Germany, making a total of 751.

- The allocation of seats is laid down in the European Union treaties. The countries with larger populations have more seats than those with smaller ones (economic indicators or size of the territory don’t matter in this case), but the latter have more seats than strict proportionality would imply.

- This system is known as the “degressive proportionality”

- With the departure of the 73 British members, the MEPs and Council have agreed to reduce the size of the EP from 751 to 705 seats as of the 2019 elections.

- This reduction would leave room for possible future enlargements of the Union, while the rest of seats the UK leaves vacant will be reallocated to countries which were rather underrepresented.

- The minimum age is 18 except in Austria and Malta (where it’s 16) and Greece (where it’s 17).

- Voting is compulsory in Belgium, Bulgaria, Cyprus, Greece and Luxembourg – although this rule is not always enforced.

- The European Parliament is located in three places – Brussels (Belgium), Luxembourg City (Luxembourg) and Strasbourg (France).

- Elections to the European Parliament are largely governed by national electoral laws and traditions, but there are some common EU rules, laid down in the Electoral Act of 1976.

- EU citizens vote for the candidates or parties of their country of origin or residence, provided that they are registered.

- Those living overseas can use their country’s embassies, consulates or schools to vote for a candidate running in their home country.

- After the elections, MEPs form political groups. These groups bring together MEPs from different Member States on the basis of their political affinities. Currently there are 8 political groups in the European Parliament.

- To get the formal status of a political group it must consist of at least 25 MEPs, elected in at least one-quarter of the member states (i.e. at least 7). MEPs may only belong to one political group.

- When a group is set up, the President of Parliament must be notified in a statement specifying the name of the group, its members and its presidium.

Low turnout!

- Despite the important role the parliament plays, voter turnout has dropped from 62% in 1979 to 43% in 2014. In some countries, participation is incredibly low. Only 13% of Slovakian voters went to the polls in the last elections.

European Union

- The European Union is a unique economic and political union between 28 EU countries that together cover much of the continent.

- The predecessor of the EU was created in the aftermath of the Second World War.

- The first steps were to foster economic cooperation: the idea being that countries that trade with one another become economically interdependent and so more likely to avoid conflict.

- The result was the European Economic Community (EEC), created in 1958, and initially increasing economic cooperation between six countries: Belgium, Germany, France, Italy, Luxembourg and the Netherlands.

- Since then, 22 other members joined and a huge single market (also known as the ‘internal’ market) has been created and continues to develop towards its full potential.

- A name change from the European Economic Community (EEC) to the European Union (EU) was happened in 1993.

What Countries Are EU Members

- The EU’s 28 member countries are: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and the United Kingdom.

- That will drop to 27 after Brexit causes the United Kingdom to leave the EU in 2019.

How It Is Governed

- Three bodies run the EU. The EU Council represents national governments.

- The EU Council sets the policies and proposes new legislation. The political leadership, or Presidency of the EU, is held by a different leader every six months.

- The Parliament is elected by the people. The European Parliament debates and approves the laws proposed by the Council. Its members are elected every five years.

- The European Commission is the EU staff. They make sure all members act consistently in regional, agricultural, and social policies.

Currency

- The euro is the common currency for the EU area. It is the second most commonly held currency in the world, after the U.S. dollar.

- The value of the euro is free-floating instead of a fixed exchange rate. As a result, foreign exchange traders determine its value each day.

The Difference Between the Eurozone and the EU

- The eurozone consists of all countries that use the euro. All EU members pledge to convert to the euro, but only 19 have so far. The eurozone was created in 2005.

- The European Central Bank is the EU’s central bank. It sets monetary policy and manages bank lending rates and foreign exchange reserves. Its target inflation rate is less than 2 percent.

The Schengen Area

- The Schengen Area guarantees free movement to those legally residing within its boundaries. Residents and visitors can cross borders without getting visas or showing their passports.

- In total, there are 26 members of the Schengen Area.

- Two EU countries, Ireland and the United Kingdom, have declined the Schengen benefits.

- Four non-EU countries, Iceland, Liechtenstein, Norway, and Switzerland have adopted the Schengen Agreement.

- Three territories are special members of the EU and part of the Schengen Area: the Azores, Madeira, and the Canary Islands.

- Three countries have open borders with the Schengen Area: Monaco, San Marino, and Vatican City.

- This chart shows which countries are members of the EU, the eurozone, and the Schengen Area.

Trade

- The European Union is the largest trade block in the world. It is the world’s biggest exporter of manufactured goods and services, and the biggest import market for over 100 countries.

- Free trade among its members was one of the EU’s founding principles. This is possible thanks to the single market. Beyond its borders, the EU is also committed to liberalising world trade.

OPEN MARKET OPERATIONS (OMO’S)

Context: The Reserve Bank of India said that it will conduct an auction to purchase government securities under Open Market Operation (OMO) for ₹15,000 crore to infuse durable liquidity.

Essentials

- Open Market Operations are defined as purchase and sale by central bank of variety of assets such as foreign exchange, gold, Government securities or treasury bills and even company shares.

- The objective of OMO is to regulate the money supply (liquidity) in the economy.

- Liquidity has a bearing on both interest rates and inflation rates.

- When the RBI wants to increase the money supply in the economy, it purchases the government securities from the market and it sells government securities to suck out liquidity from the system.

- RBI carries out the OMO through commercial banks and does not directly deal with the public.

- OMO is one of the major monetary policy instruments that RBI uses to smoothen the liquidity conditions through the year and minimise its impact on the interest rate and inflation rate levels.

- These operations are often conducted on a day-to-day basis in a manner that balances inflation while helping banks continue to lend.

- The RBI uses OMO along with other monetary policy tools such as repo rate, cash reserve ratio and statutory liquidity ratio to adjust the quantum and price of money in the system.

- If central bank signals that it will move to a ‘neutral’ liquidity stance from a ‘deficit’ stance, it means more liquidity in the system in future. This could arm banks with more funds for lending, and lead to softer interest rates in the economy.

MONETARY VS FISCAL POLICY

- Monetary policy(formulated by the central bank or currency board) controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.

Instruments of monetary policy

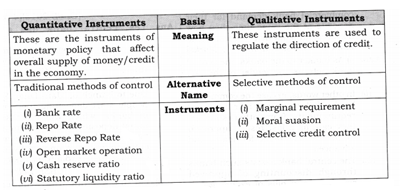

These instruments can be categorized as:

- Quantitative Measures: These are the traditional measures of monetary control. All the quantitative methods affect the entire credit market in the same direction. This means their impact on all the sectors of the economy is uniform.

- Selective Credit Controls: The credit objectives of these methods may include rationing the credit, directing the flow of credit from least important sectors to the most important sectors, controlling a speculating tendency based on the availability of bank credit.

Some of the instruments of the monetary policy are:

- Moral suasion – A moral suasion is a persuasion tactic used by an authority to influence and pressure, but not force, banks into adhering to policy.

- Credit rationing – Credit rationing is the limiting by lenders of the supply of additional creditto borrowers who demand funds, even if the latter are willing to pay higher interest rates.

- The Repo Rateis the rate at which commercial banks borrow from RBI while the Reverse Repo Rate is the opposite of Repo rate. It is the rate at which RBI borrows from the commercial banks against the government securities.

- The Repo Rate increases the money supplywhile the Reverse Repo Rate decreases the money supply in the economy.

Monetary Vs Fiscal Policy

- Monetary policy involves changing the interest rate and influencing the money supply.

- Fiscal policy involves the government changing tax rates and levels of government spending to influence aggregate demand in the economy.

Administered by:

- Fiscal policy: Ministry of Finance

- Monetary policy: Central Bank/RBI

Focuses on:

- Fiscal policy: Economic Growth

- Monetary policy: Economic Stability

Political influence:

- Fiscal policy: Yes

- Monetary policy: No

- Monetary policy is quicker to implement. Interest rates can be set every month.

- A decision to increase government spending may take time to decide where to spend the money.

Monetary Policy Committee (MPC)

- The Monetary Policy Committee (MPC) is a committee of the Central Bank in India (Reserve Bank of India), headed by its Governor.

- It is entrusted with the task of fixing the benchmark policy interest rate (repo rate) to contain inflation within the specified target level.

- Repo rateis the rate at which the central bank of a country lends money to commercial banks in the event of any shortfall of funds. It is also used by monetary authorities to control inflation.

- Reverse repo rateis the rate at which the central bank of a country borrows money from commercial banks within the country. It is a monetary policy instrument which can be used to control the money supply in the country.

- It is defined and constituted under the Reserve Bank of India Act, 1934 to provide for a statutory and institutionalised framework, for maintaining price stability, while keeping in mind the objective of growth.

Composition:

- The new MPC is to be a six-member panel.

- It will feature three members from the RBI — the Governor, a Deputy Governor and another official — and three independent members to be selected by the Government.

- A search committee will recommend three external members, experts in the field of economics, banking or finance, for the Government appointees.

- The meetings of the Monetary Policy Committee shall be held at least 4 times a year and it shall publish its decisions after each such meeting.

- The decisions on monetary policy are taken by a majority vote.

- And if there’s a tie, the RBI governor gets the deciding vote.

- The Members of the Monetary Policy Committee appointed by the Central Government shall hold office for a period of four years.

- Inflation Targets:

- Inflation Target: Four per cent.

- Upper tolerance level: Six per cent.

- Lower tolerance level: Two per cent.

- In case the inflation target is failed to achieve (2% higher or lower than the set target of 4% for continuous three quarters), the RBI has to give an explanation to the government about the reasons, the remedial actions and the estimated time for realizing the target.

- Another responsibility for the RBI is to publish a Monetary Policy Report every six months, elaborating inflation forecasts and inflation sources for the next six to eighteen months.

- MPC uses ‘headline inflation’ to take its decision. Headline inflation is the raw inflation figure reported through the Consumer Price Index (CPI).